24 Apr QuickBooks Online Plus — Deferred Revenue

In a prior issue of Ed Talks (Jan 2025), I described the QBO Advanced feature of revenue recognition. This article describes the procedures to record deferred revenue in any edition of QuickBooks – the examples are from QuickBooks Online Plus.

Deferred revenue refers to money received by a business for goods or services that have not yet been delivered or performed. It is considered a liability because it represents an obligation to provide goods or services in the future.

Considerations:

1. Liability: Deferred revenue is recorded as a liability on the balance sheet until the goods or services are delivered. The account name can also be Customer Deposits or Retainers or Funds held in Escrow or Gift Cards Outstanding.

2. Recognition: Once the goods or services are provided or a gift card is redeemed, the deferred revenue liability account is reduced, and the funds are recognized as actual revenue on the income statement.

3. Examples: Prepaid subscriptions to a magazine publisher, advance payments for services to a lawyer, and deposits for future work to a contractor or consultant.

Although not recommended, one simple way to handle prepayments is to record a Customer Payment transaction without matching it to an invoice. Using this method, you will eventually enter an invoice later when the service is provided and the earlier prepayment would then be matched to the invoice, clearing the negative A/R. This creates a negative Accounts Receivable, which is not proper accounting and distorts the balance truly owed to you by customers.

Handling customer prepayments properly in QuickBooks involves a few steps to ensure accurate tracking and application. Here’s a general guide:

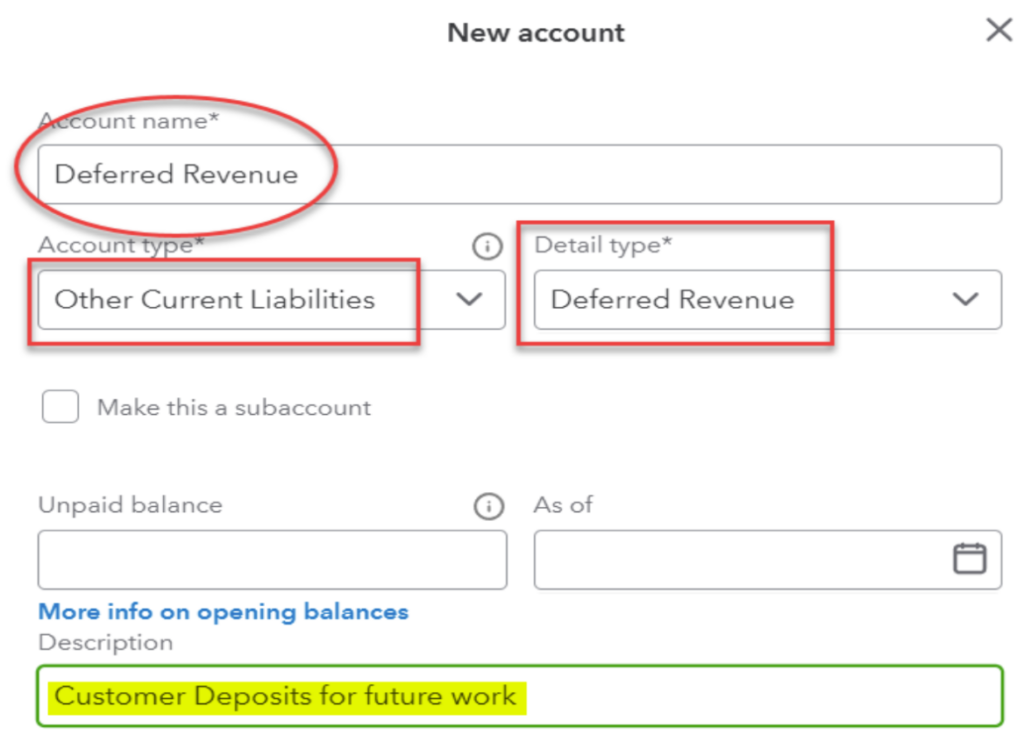

1. Set Up Deferred Revenue Account:

- Go to Accounting > Chart of Accounts.

- Click New.

- Select Other Current Liabilities and enter the account name (e.g., “Deferred Revenue” or “Customer Deposits”).

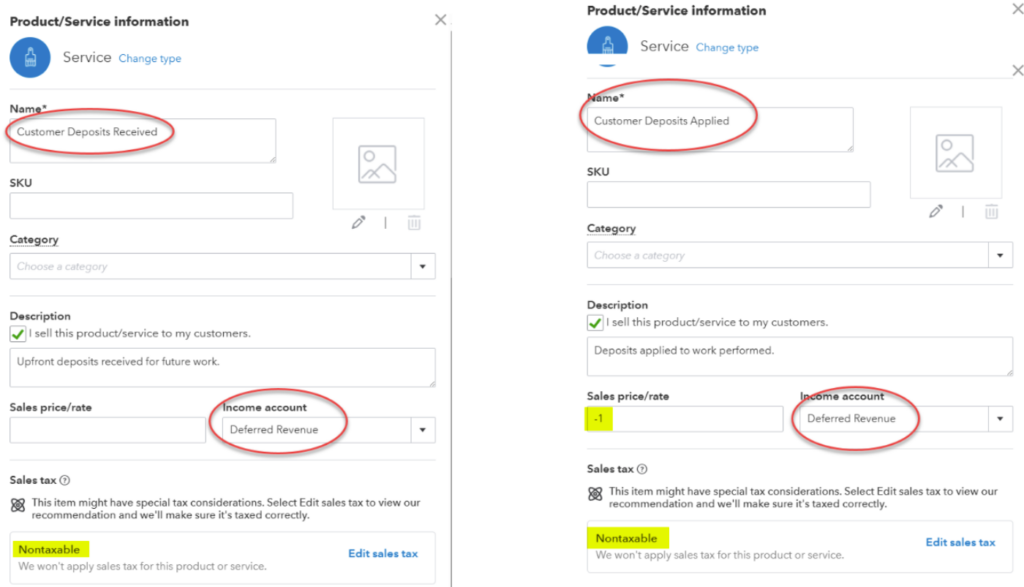

2. Create Service Items:

- Go to Sales > Products and Services.

- Click New.

- Create two service products: Customer Deposit Received and Customer Deposit Applied, both non-taxable items linked to the deferred revenue account created in step 1. Use a rate of -1 on the Applied item.

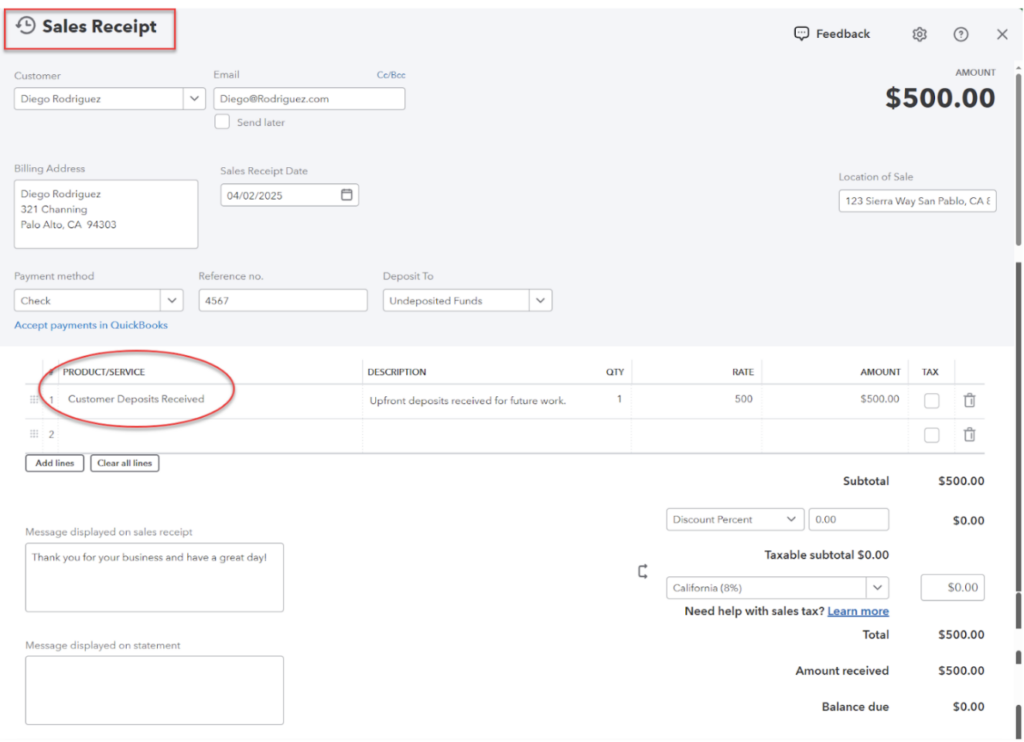

3. Record Prepayment:

- Create a Sales Receipt using Customer Deposit Received for the prepayment amount when it is first collected.

4. Apply Prepayment to Invoice:

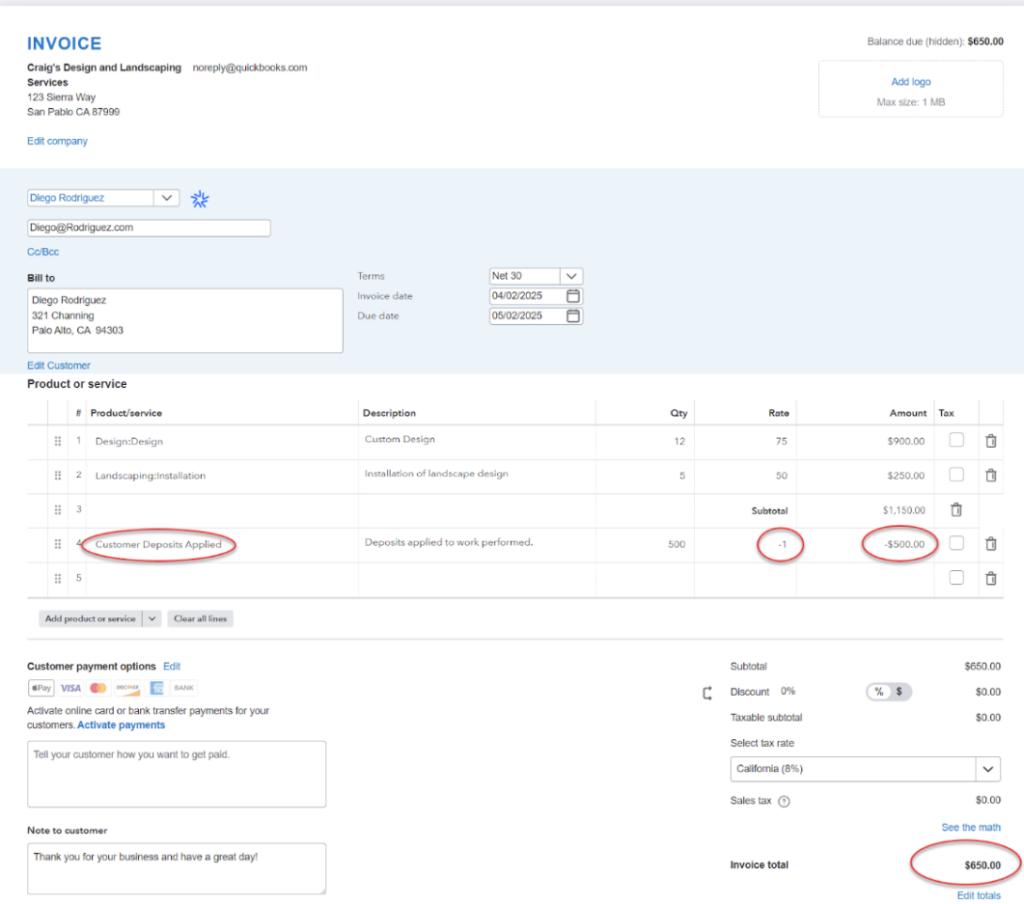

- Create an Invoice for the work done, using Customer Deposit Applied as an additional line item with a negative amount to offset the prepayment. Any balance remaining for services delivered over the retainer applied will show as the balance due on the invoice.

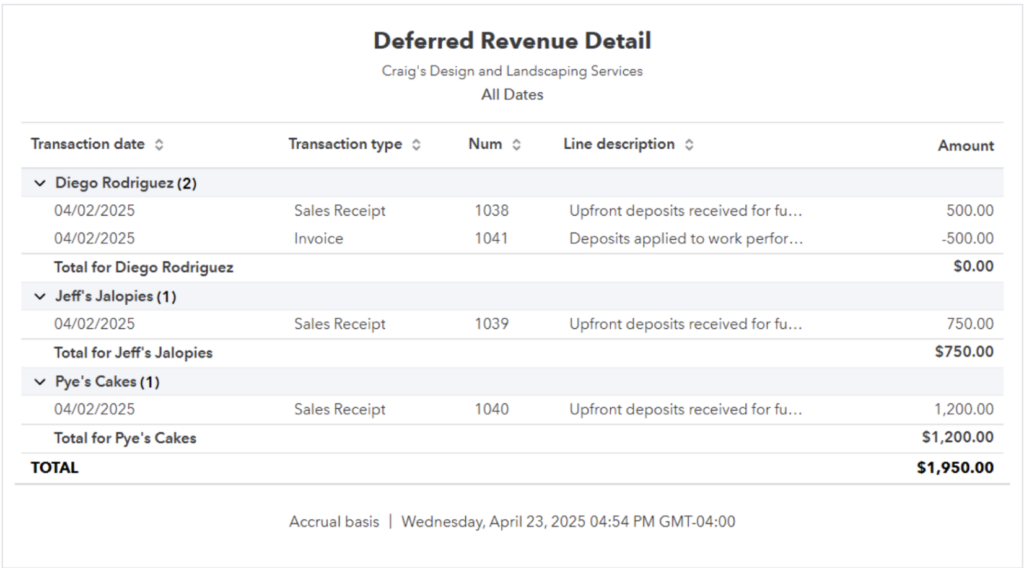

Create a custom report showing the balance of the Deferred Revenue account grouped by Customer.

1. Start with a Transaction Detail by Account report

2. Filter for:

- Distribution account = Deferred Revenue

- Cleared = Uncleared

3. Group By Customer

4. Report Period = All Dates

Don’t forget to save the report settings so it can be rerun from the Custom Report menu.

When a customer’s deposit balance has been fully applied, reconcile the deferred revenue account to a balance of zero and mark off the initial Sales Receipt transaction (Charges) and all corresponding invoices where the deposit was applied (Payments). The Cleared filter used on the report settings will now omit those lines from the report.

These steps will help you manage customer prepayments efficiently in QuickBooks. If you need more detailed instructions, please reach out to us at Siegel Solutions – we can help!