23 Jun What Happened to My Money? The Statement of Cash Flows

In prior editions of Ed Talks, I’ve focused on specific features of QuickBooks. In this edition, in keeping with this month’s “what keeps me up at night?” theme, I will focus on one of the primary financial statements, the “Statement of Cash Flows”.

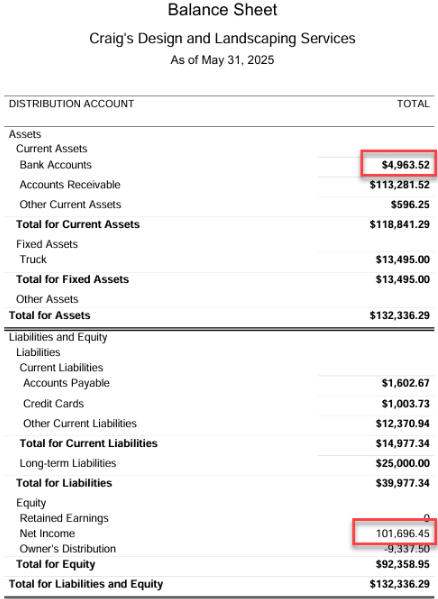

I often hear from small business owners: “How come my Income Statement says I made over $100,000 but my bank account only has $5,000?”.

Continue reading to gain a deeper insight into your cash flow statement, or feel free to email us with any questions for personalized assistance.

The question is answered in the Statement of Cash Flows. This statement is also known as the “Sources and Uses of Funds”. In my consulting experience, I have worked with some companies that scrutinize this report regularly and some companies that never look at it. The statement of cash flows provides a clear picture of how cash enters and exits a company during a specific period. Unlike the income statement, which reflects profitability, or the balance sheet, which showcases financial position, the statement of cash flows focuses solely on the liquidity dynamics of an organization. This document is used by investors, creditors, and financial analysts as it reveals the company’s ability to generate cash and manage its cash reserves efficiently.

Definition and Purpose

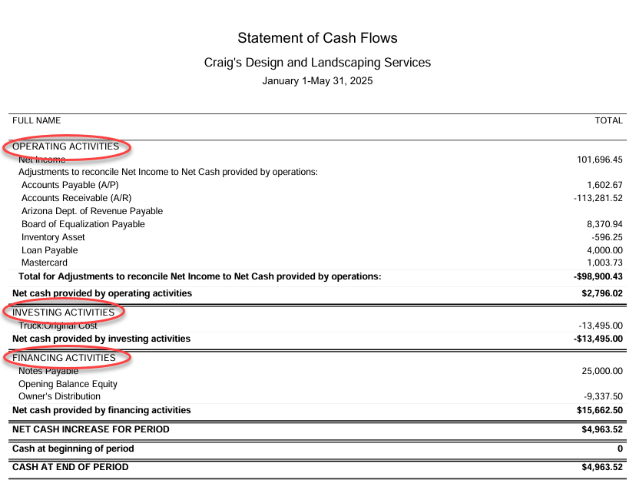

The statement of cash flows serves as a bridge between the income statement and the balance sheet. It categorizes cash movements into three main activities: operating, investing, and financing. By analyzing this statement, stakeholders can determine whether a company has sufficient liquidity to sustain operations, fund capital investments, and repay obligations.

The primary purposes of the statement of cash flows include:

- Providing transparency into cash inflows and outflows.

- Helping assess a company’s liquidity and financial health.

- Identifying the sources of cash generation and its application.

- Facilitating comparisons across periods or between companies.

Components of the Statement of Cash Flows

The statement of cash flows is divided into three key sections, each representing a distinct area of cash management:

1. Operating Activities

This section highlights cash flows arising from the core operations of the business. It includes transactions related to the production and delivery of goods or services. The Operating section starts with the Net Income and includes the net change in current asset and current liability balances. For example, an increase in the Accounts Receivable balance is viewed as a use of funds (a sale was made but not yet collected). An increase in the Credit Card balance is a source of funds (expenses incurred but not yet paid for).

Operating cash flow is crucial as it reflects the company’s ability to generate cash from its regular business activities. A positive operating cash flow often indicates healthy operations, while a negative flow may signal potential challenges.

2. Investing Activities

Investing cash flows involve the acquisition and disposal of long-term assets and investments. It reflects the company’s strategy in terms of growth and expansion. Key transactions under this section include:

- Purchase or sale of property, plant, and equipment (PPE / fixed assets).

- Investments in securities or other businesses.

- Proceeds from the sale of assets.

Investing activities can demonstrate whether a company is reinvesting in its future or divesting assets for liquidity purposes.

3. Financing Activities

This section focuses on cash flows related to funding the business. It includes transactions with shareholders, creditors, and debtors. Common examples are:

- Issuance of equity or debt.

- Repayment of loans or dividends paid to shareholders.

- Proceeds from bond issuance.

Financing cash flows help gauge the financial strategy of the organization—whether it relies on external funding or returns value to its shareholders.

Examples of Cash Flow Problems

Despite its importance, businesses can encounter cash flow issues that hinder their operations and financial stability. Here are some common examples:

- Delayed Payments from Customers: When customers take longer than agreed to pay invoices, it creates a shortfall in cash needed for day-to-day operations.

- Excessive Inventory Holding: Investing too much in inventory ties up capital, leaving insufficient cash for other expenses.

- High Debt Obligations: Large loan repayments or interest expenses may deplete cash reserves, especially if revenue generation is inconsistent.

- Unexpected Expenses: Emergency repairs, legal costs, or sudden regulatory fees can disrupt planned cash flows.

- Overinvestment in Fixed Assets: Spending heavily on equipment or property without generating immediate returns can strain liquidity.

Importance of the Statement of Cash Flows

The statement of cash flows is invaluable for understanding the liquidity and solvency of an organization. Here’s why it matters:

- It helps in assessing whether a company can meet its short-term and long-term obligations.

- Investors use it to evaluate the sustainability of dividend payouts and growth strategies.

- Creditors rely on it to determine repayment capability.

- Management uses it to plan financial strategies and improve operations.

Limitations

Despite its importance, the statement of cash flows does have limitations:

- It does not provide insights into profitability, only liquidity.

- Non-cash transactions such as depreciation and amortization are excluded.

- It does not capture future cash inflows or outflows.

Hence, it should be analyzed in conjunction with other financial statements for a holistic understanding of a company’s financial position.

The statement of cash flows is a cornerstone of financial analysis and decision-making. It provides a detailed view of a company’s ability to generate and manage cash, offering insights that are essential for investors, creditors, and management. While not without its limitations, its significance in understanding the liquidity dynamics of a business cannot be overstated. By studying cash flows, stakeholders can better anticipate challenges, seize opportunities, and make informed financial decisions.

If you would like some help understanding the cash flow statement (or any other statement) in your books, we’re here for you! Gain a better understanding of your cash flow statement.