23 May Bank Transactions in QuickBooks Online

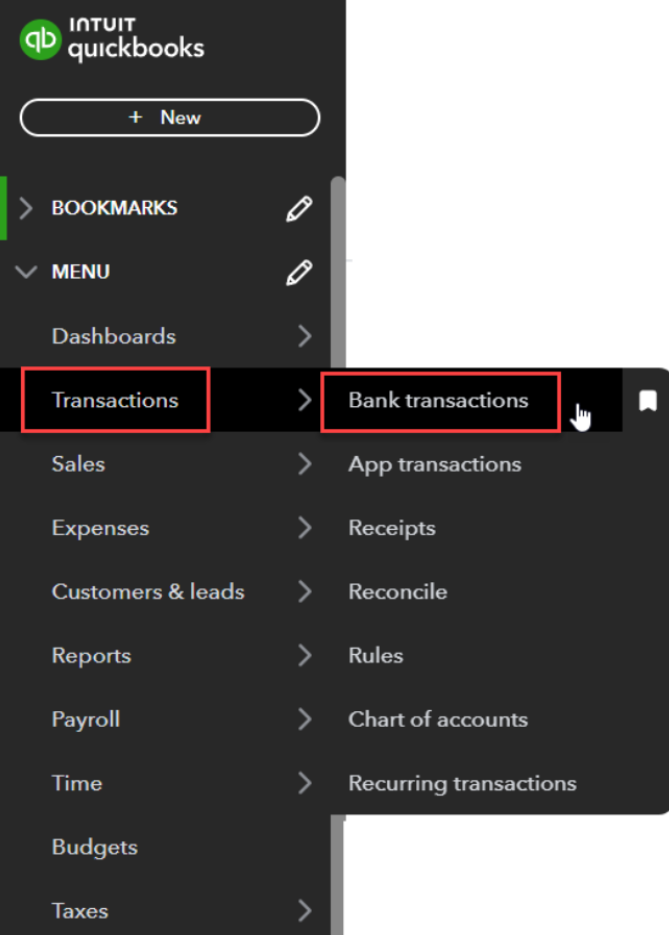

In this installment of Ed Talks, I will take a deep dive into the Bank Transactions feature of QuickBooks Online (QBO). QuickBooks Desktop editions offer very similar features, but the online version works better due to the always connected nature of the software.

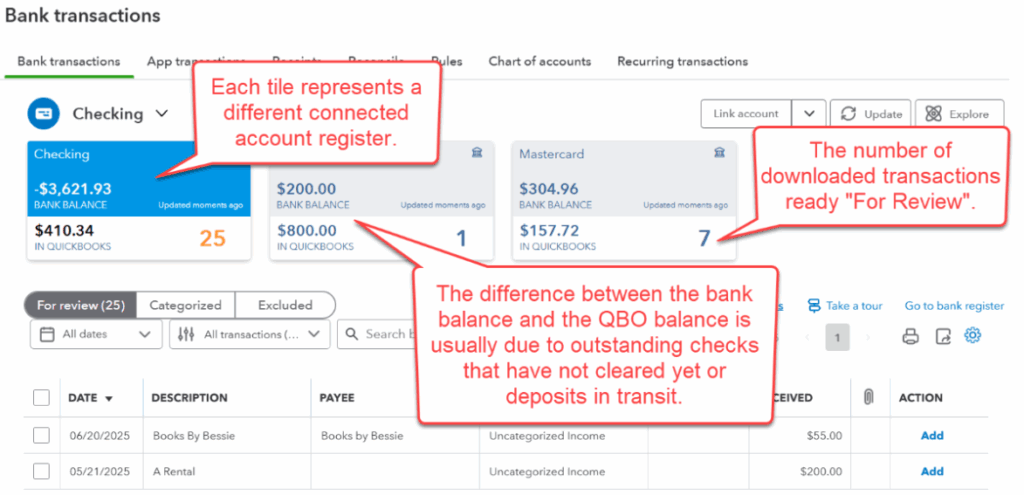

When you connect your bank account to QuickBooks Online (QBO), the system automatically downloads all bank-cleared transactions to QBO every day into a “For Review” queue. By “bank accounts”, I am referring to any account that produces a statement, including credit cards, line of credit, and loan accounts. Keeping your QBO file in sync with bank activity offers several benefits:

- Keeps your books up to date, allowing you to be more proactive and less reactive

- Makes it easier to enter financial activity by automating the entry of transaction dates, amounts, payees, and categories

- Utilizes business intelligence to help you classify activity consistently based on bank memos

- Regular use of bank feeds greatly streamlines the monthly reconciliation process by pre-checking all cleared activity

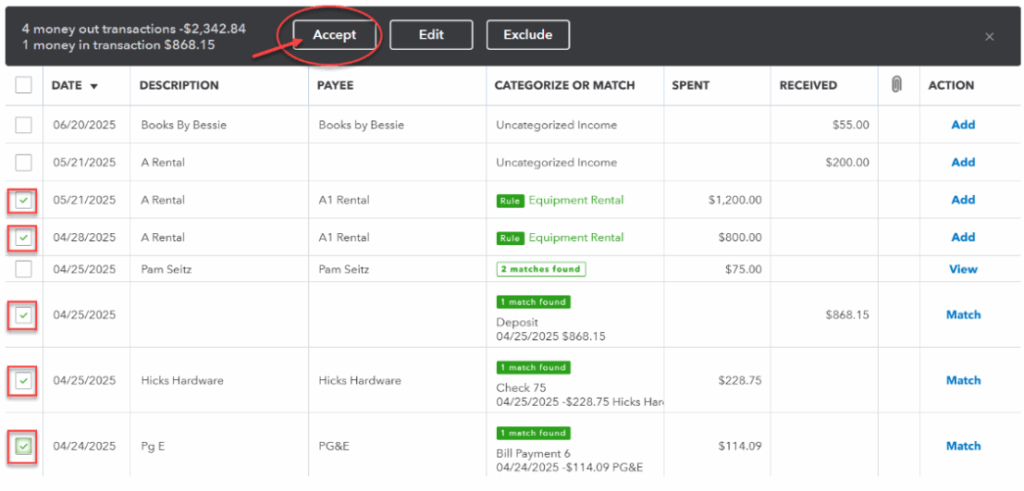

Three things can happen with a bank downloaded transaction:

- It can be matched to an existing transaction based on amount and check number

- You can search for a match if one is not found automatically. On “find a match”, you can connect several detail entries that add up to a bank transaction’s total amount.

- You can add a transaction to your QBO register from the bank data. Bank rules further automate adding transactions.

Pro tips:

- Only Match, do not add, cash receipts. Adding cash received coded to Revenue will double-count the revenue already recorded on an invoice.

- Don’t accept Uncategorized Expenses or Uncategorized Revenue when adding – use the proper account code.

- A Payee should be filled in for all transactions for better reporting and analysis

- Be careful of pre-filled in payee names, they are often wrong based on a past entry.

- Occasionally, usually due to changes in the bank’s security protocols, you may have to disconnect and reconnect the bank link.

- When connecting or reconnecting a bank, set the date filter to go back no further than the last reconciliation date or the last download (if reconnecting).

If multiple transactions are selected from the checkbox on the left, the batch action bar applies to all selected.

Matching Transactions

QuickBooks tries to match downloaded transactions with the ones you’ve already entered in your books. For example, if you record a payment to a vendor, QuickBooks will look for a matching transaction from your bank feed. If it finds a match, it will suggest it to you. You can confirm the match to keep your records accurate.

Sometimes, QuickBooks will find several matching candidates with the same amount. For these, click anywhere on the transaction line and select the proper one – usually based on the date or Payee name.

A transaction is not eligible for matching if it has been reconciled. For this reason, it is important to clear the “For Review” list before doing monthly bank reconciliations.

Bank Rules

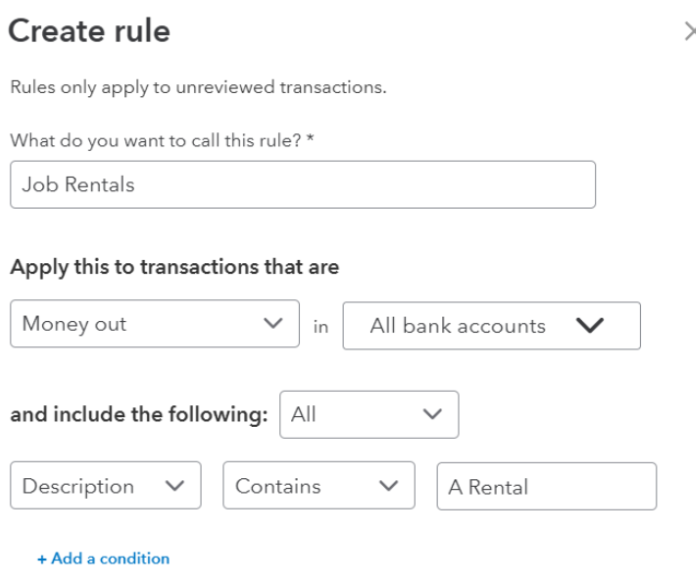

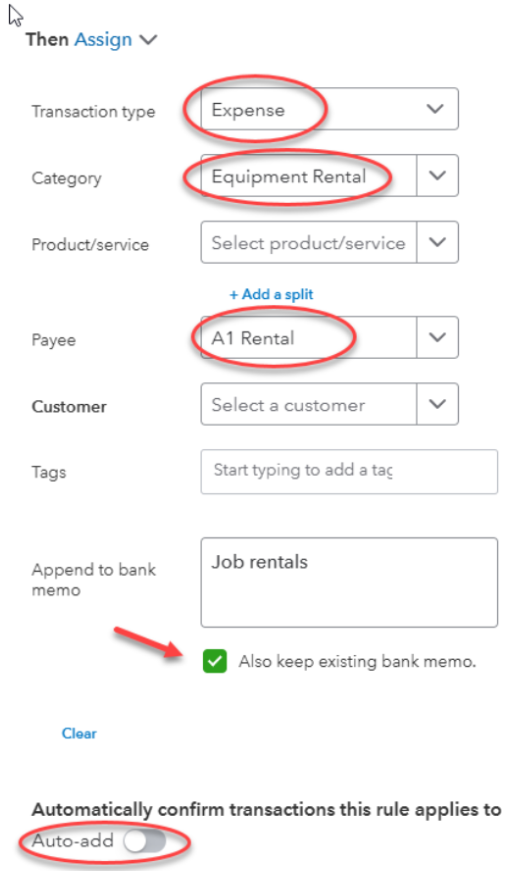

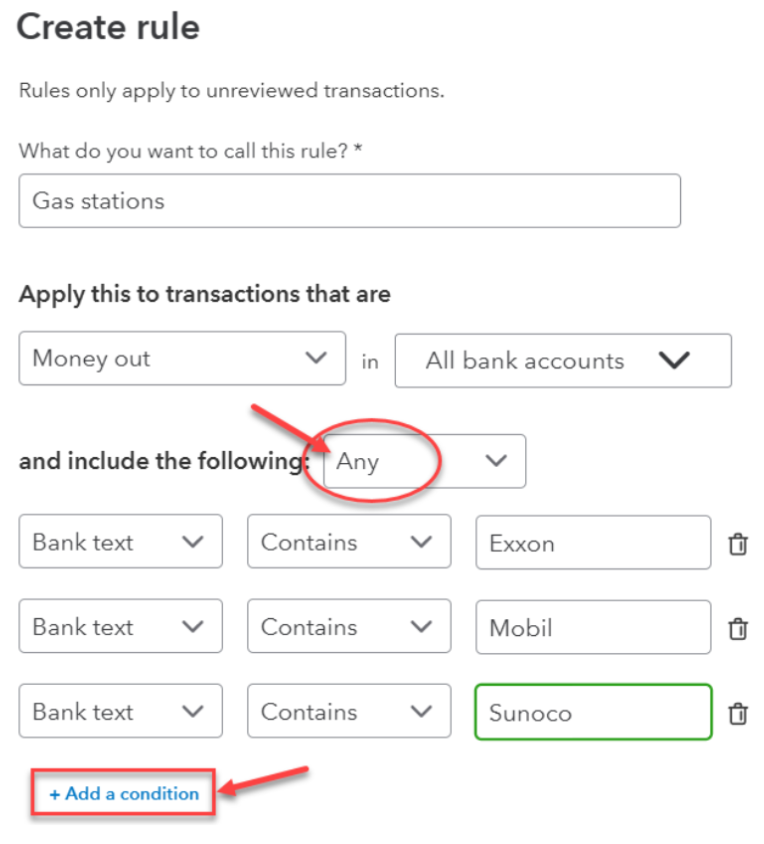

Bank rules help automate the categorization of transactions. You can create rules to automatically categorize transactions based on criteria you set, such as the description, amount, or bank text. For example, you can create a rule that categorizes all transactions from “Office Supplies Store” as office expenses. This saves time and ensures consistency in your records. You can also prioritize, copy, edit, delete, and export these rules.

Rule conditions:

Rule Actions:

Pro tips for bank rules:

- Use compound rules, like restaurants or gas stations (see example below)

- Rules can split transactions by amount or percentage

- Don’t use Auto-Add so you can review rules for accuracy before they are posted to your register. If Auto-Add is on, you never see the results of the rule and may not be able to detect an incorrect rule (my personal preference).

- When to use Bank Rules vs. Memorized transactions:

- Use Bank Rules when amounts change each month (like utility bills)

- Use Memorized transactions when the amount is consistent (like rent)

Example of a compound rule:

Categorization History

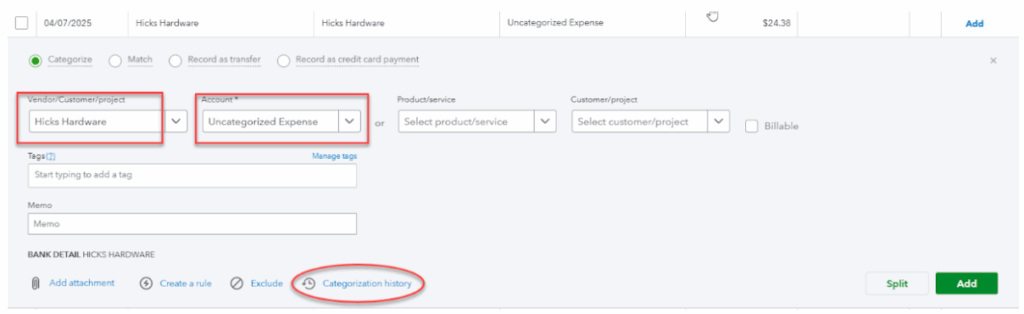

To see more details about a bank transaction, click anywhere on the transaction line:

Select the payee name and account or product/service and click “Add”.

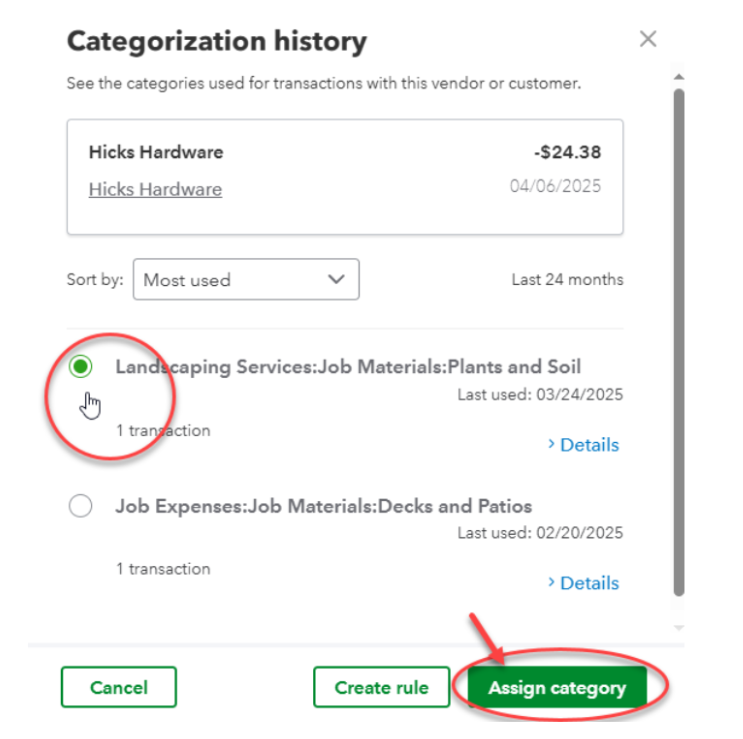

QBO keeps a history of how you’ve categorized transactions in the past. This helps the system learn and improve its suggestions over time. When you download new transactions, QuickBooks will use this history to suggest categories based on your previous actions. This feature makes it easier to maintain consistency and accuracy in your bookkeeping. To help select the proper category, click on “categorization history” to see how entries from this vendor were coded in the past. Select the proper one and hit “Assign category”:

Bank feeds along with bank rules and categorization history go a long way in keeping your books accurate and up to date. By applying these available “business intelligence” features, you can work smarter. As always, if you have any questions or want to learn more, feel free to contact Siegel Solutions.