25 Jul Mid-Year Checklists, Tax Moves & AI Tools — Let’s Finish the Year Strong!

It’s hard to believe we’re already staring down the back half of the year. Summer may be in full swing, but now’s actually the perfect time to slow down (just for a moment) and take stock of where your business stands—and where you want to be by year-end.

One of the most powerful tools we recommend? A good, old-fashioned checklist.

But not just any list—think of it as your financial GPS for the second half of the year. Whether it’s planning for cash flow, reviewing your expenses, or making strategic tax decisions before December 31st, having a solid plan in writing will help you get ahead instead of falling behind.

If you need help, don’t hesitate to reach out to Siegel Solutions today and start preparing for your year-end financial goals. Until then, check out these checklists.

🔍 Key Checklists You Should Be Thinking About Right Now

Here are a few categories we suggest you review (and yes, we’re happy to help you build these out):

📋 Bookkeeping & Accounting Health Check

– Are all your accounts reconciled through June?

– Any uncategorized transactions sitting in QuickBooks?

– Are your financial reports giving you real insights—or just numbers?

💰 Cash Flow & Budget Planning

– Are you on track with your revenue goals?

– Do you have a 6-month cash forecast?

– Are there recurring expenses that no longer make sense?

📦 Inventory, Projects, or Jobs Review

– Are you still carrying inventory that isn’t moving?

– What projects are profitable—and which ones need rethinking?

📄 Tax Planning (the exciting stuff!)

With the recent passage of that shiny new tax bill, there may be fresh opportunities to take advantage of deductions, credits, and entity-level planning strategies—but timing is everything.

Let’s proactively review:

– Accelerating expenses or deferring income

– Retirement plan contributions (especially if you’re an S-Corp)

– Equipment purchases or vehicle decisions

– R&D or energy-related credits

🤖 Want to Supercharge Your List Building? Say Hello to AI.

If making these checklists feels like one more thing on your already full plate—good news: AI can help.

You can actually prompt AI tools to help you create these lists based on your specific needs.

Here’s how to get started:

1. Open ChatGPT or your favorite AI tool.

2. Use a prompt like: “Create a mid-year checklist for a [your industry] business including tax planning, cash flow management, and bookkeeping review.”

3. Once the list is generated, copy it into Word, Google Docs, or even your task manager app.

4. From there, edit it, assign deadlines, and turn it into a real, actionable plan.

Some of our favorite tools for this include:

– ChatGPT

– ClickUp or Notion AI for dynamic checklists

– Microsoft Copilot for Excel-based planning

📥 Exporting Your Checklists with AI

Once your AI tool generates your checklist, don’t stop there. Most AI tools (like ChatGPT or Microsoft Copilot) can help you take the next step too.

Just ask: “Can you format this checklist into a downloadable PDF, Word document, or Excel spreadsheet?”

This allows you to instantly turn your list into something you can share with your team, keep in your records, or integrate into your project management system. If you’re working with your team remotely or using a virtual assistant, this step is key.

🧾 Additional Mid-Year Checklists to Consider

🛠️ Operational Efficiencies

– Are your internal processes still serving you—or slowing you down?

– Can any manual steps in your billing, invoicing, or reporting be automated?

– Have you reviewed your tech stack lately for outdated or duplicate tools?

📈 Sales & Marketing Alignment

– Are your current revenue streams aligned with your marketing spend?

– What’s working well in lead generation and what needs adjusting?

– Do your sales and marketing KPIs reflect your business goals for the second half?

👥 HR & Team Structure

– Have job roles shifted in the last 6 months?

– Are you planning to hire, promote, or outsource any roles before year-end?

– Have you documented key processes for onboarding or training new team members?

📊 KPI & Metrics Review

– Are your core financial and operational KPIs clearly defined and tracked?

– Do you review these metrics monthly or quarterly?

– Is your dashboard (in QuickBooks, Reach Reporting, etc.) still giving you meaningful data?

📉 Balance Sheet Review Checklist

– Review bank account balances for accuracy and reconciliation status

– Confirm credit card liabilities match your statements

– Review loan balances, interest expense, and amortization

– Scrub accounts receivable: are all invoices collectible? Any bad debts?

– Scrub accounts payable: are there old unpaid bills that need resolution?

– Review fixed assets: are depreciation schedules current? Any disposals not recorded?

– Double-check equity accounts for unusual entries or draws

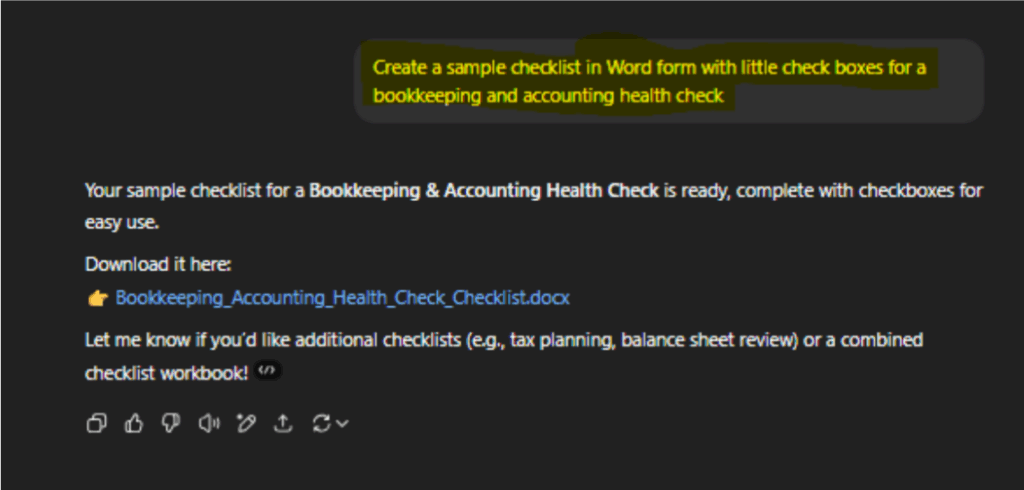

Let me give you an example, using ChatGPT, I prompted the following:

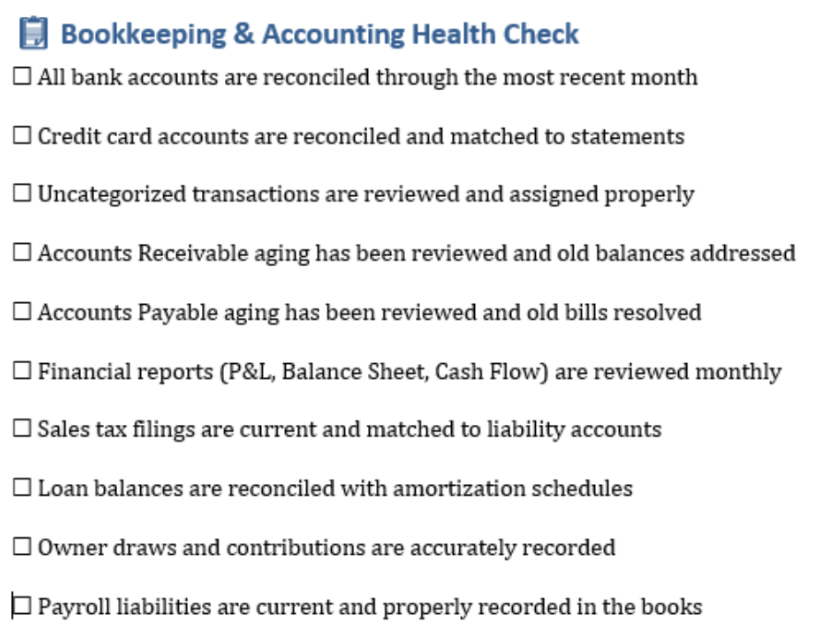

This is what I got when I opened the document:

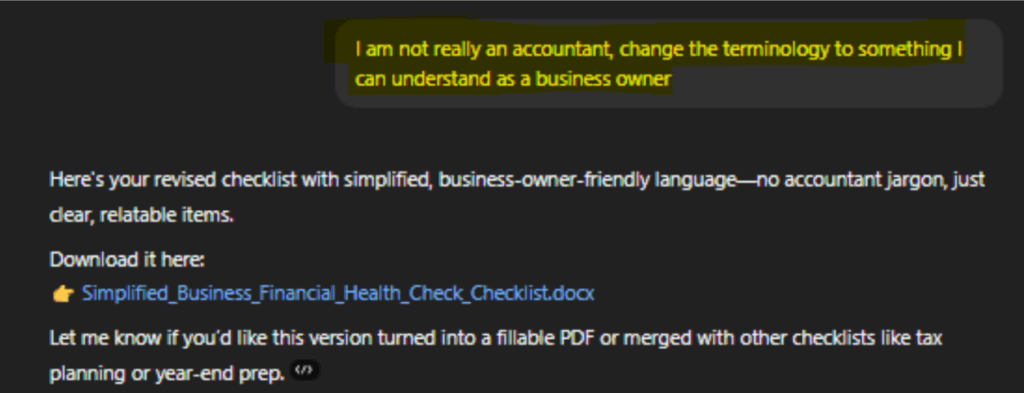

I then decided to add to my prompt that I was not an accountant. Could it create a checklist I could understand?

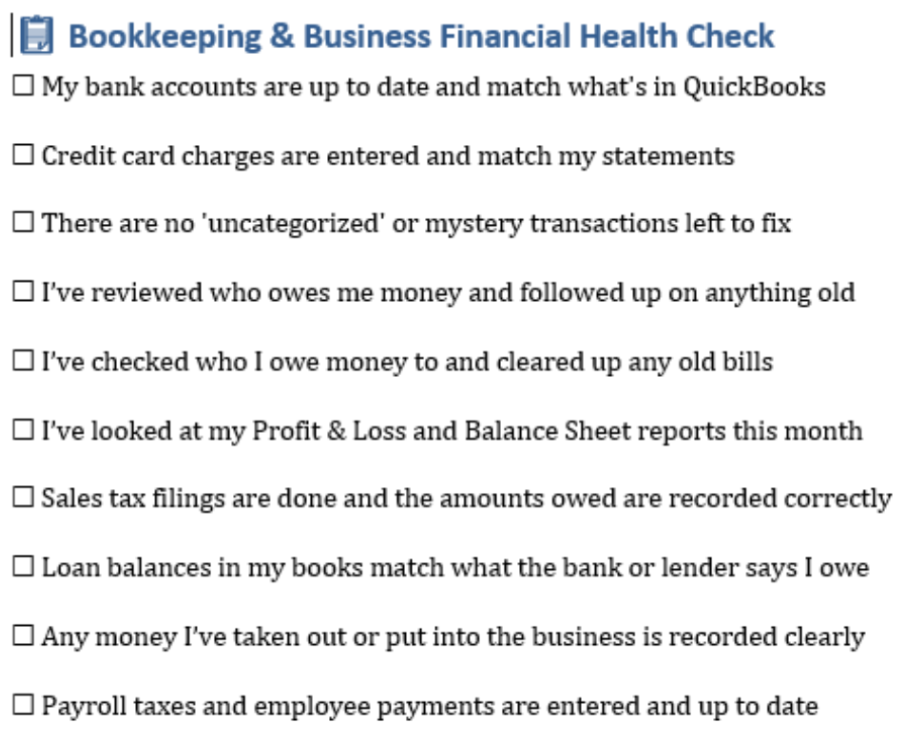

The result below, made it easier for a non accountant to understand, for example, the above output had an item that said “Owner Draws and Contributions are accurately recorded” while the output below changed that to “Any money I have taken our or put into the business is recorded clearly”

Also note, AI is asking if you want this into a fillable pdf or merged with other checklists!

🧭 Need a Jumpstart?

If you want help creating a mid-year checklist tailored to your business—or want to understand how AI can be used in your business—we’re just a phone call or email away.

Whether it’s digging into your numbers or helping you leverage AI to work smarter, we’re here to support your growth.

Let’s finish strong together.