27 Jan QuickBooks Online Advanced Revenue Recognition

In previous editions of Ed Talks, I discussed some of the features unique to the QuickBooks Online (QBO) Advanced product. Another feature exclusive to QBO Advanced is Revenue Recognition. The Advanced Revenue feature is designed to help businesses automate and streamline their revenue recognition process where revenue is collected in advance but not recognized until products or services are delivered. Here are some key points:

1. Automated Revenue Recognition: This feature allows you to automatically track and enter deferred revenue into your books, eliminating the need for manual calculations or third-party tools.

2. Compliance with GAAP: It helps businesses stay compliant with Generally Accepted Accounting Principles (GAAP), specifically the ASC 606 standard, which defines how and when revenue should be recognized.

3. Improved Accuracy and Reporting: By automating revenue recognition, you can ensure your data is accurate, leading to better reporting, insights, and decision-making.

4. Customizable Schedules: You can set up automatic schedules to recognize revenue over time, which is particularly useful for businesses with subscription models, project-based work, or pre-paid billing.

5. Integration with Invoicing: When you create an invoice for a service, QuickBooks will automatically start the revenue recognition schedule based on the service date.

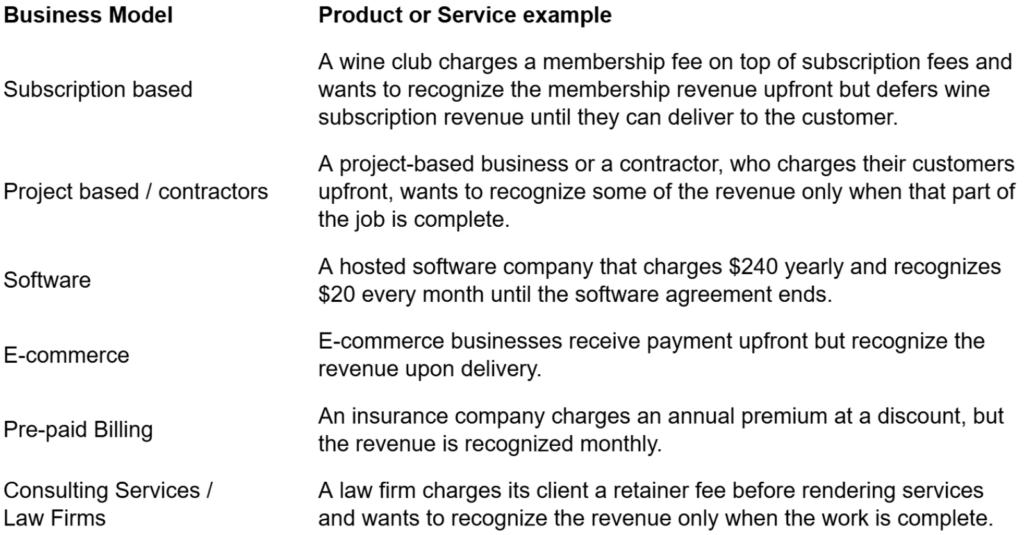

Examples of when revenue recognition is appropriate:

To set up the Advanced Revenue feature in QuickBooks Online Advanced, follow these steps:

1. Turn on Revenue Recognition:

- Go to Settings (gear icon in upper right) and select Account and settings.

- Click on the Sales tab.

- In the Products and services section, select Edit.

- Turn on Revenue recognition.

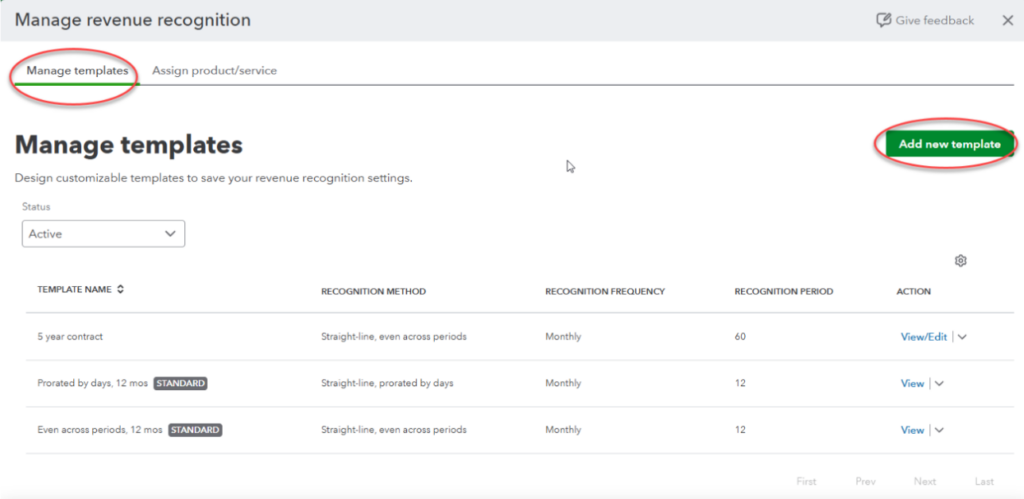

2. Create a revenue recognition template

- Go to Advanced Accounting (left navigation bar) and select Revenue Recognition

- Select Manage Templates and choose Manage templates

- Enter a template name, the recognition method (Straight-line, prorated by days or Straight-line, even across periods), the recognition frequency (Monthly, Quarterly Yearly), and the recognition period.

3. Add a Service with Revenue Recognition:

- Go to Settings and select Products & Services.

- Click New and choose Service.

- Fill out the service details.

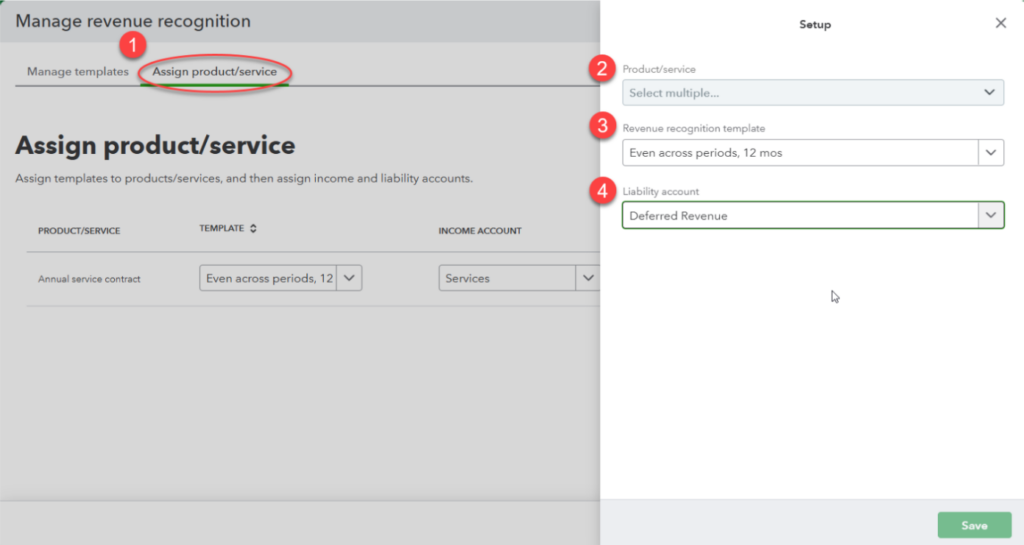

- Go to Advanced Accounting (left navigation bar) and select Revenue Recognition

- Select Assign product/service and choose Assign template to products/services

- Select one or multiple services, the revenue recognition template, and the liability account.

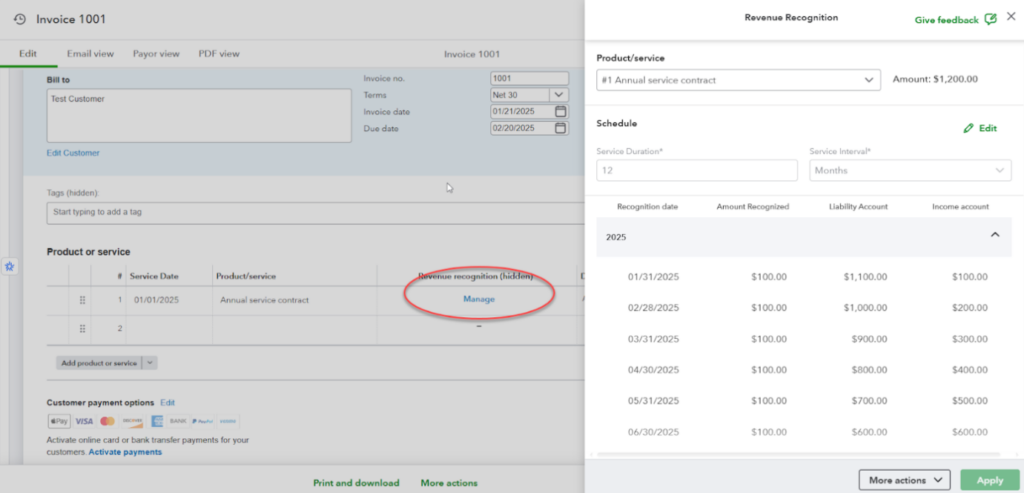

4. Create an Invoice with Revenue Recognition:

- Go to New and select Invoice.

- Fill out the invoice details, including the Service Date to start the revenue recognition schedule.

- When the invoice is saved, select the Manage button on the invoice line containing the service that is subject to revenue recognition to view the revenue recognition schedule. The revenue recognition template is used to:

- Record the invoiced amount in the liability account on the service date

- Recognize revenue following the frequency and period specified

- The revenue recognition schedule for all invoices currently being amortized can also be viewed from the Advanced Accounting > Revenue Recognition menu.

- There is also a revenue recognition report that can be filtered and exported.

For more information, see Set up a revenue recognition schedule.

The Revenue Recognition feature of QBO Advanced is an easy way to automate the complex and tedious process of manually entering journal entries or invoice work arounds to achieve the requirements of FASB Accounting Standard Codification (ASC) 606.