24 Feb QuickBooks Online for Contractors

In the past several issues of Ed Talks, I have been discussing software features only available in QuickBooks Online Advanced. In this issue, I will talk about how QuickBooks Online can be configured to satisfy many of the features needed by the construction industry.

I presented the techniques in this article at the 2025 Green Industry Winter Forum sponsored by the Massachusetts Nursery and Landscape Association (MNLA). Siegel Solutions will also have a booth next month at the annual Northeast Hardscape Expo sponsored by the New England Concrete Manufacturers Association (NECMA). I have presented “QuickBooks for Contractors” education sessions at this show in past years.

By “contractors”, I am referring to businesses such as home builders and remodelers, landscapers, plumbers, electricians, roofers, HVAC, house painters, concrete, excavation, and other trades. Here are some key features required by these industries:

- Job Costing: Track costs and revenues for individual projects to monitor profitability. This helps you understand which projects are profitable and which need attention.

- Progress Invoicing: Bill clients incrementally based on project milestones to maintain cash flow. This is particularly useful for long-term projects.

- Expense Tracking: Keep track of all bills and business expenses at the job level, essential for measuring job profitability and ensuring accurate financial management.

- Labor Job Cost: Simplify payroll processing for both employees and subcontractors, making it easier to allocate labor costs to jobs. Labor can be a significant component of total job costs.

- Integration with Construction Management Tools: Seamlessly integrate with popular tools like Buildertrend and Knowify to streamline project management.

- Customizable Reports: Generate detailed financial reports to gain insights into your business performance and make informed decisions.

- Mobile App: Manage your construction business from anywhere with the QuickBooks mobile app, allowing you to track money in and out, get alerts, and run your business on the go.

Setting up QuickBooks Online for Contractors involves several steps to ensure you can effectively manage your construction business:

1. Open the correct QuickBooks Online edition:

- Choose the QuickBooks Online plan that best fits your business needs – you need at least QBO Plus or QBO Advanced for these contractor features. You can start with a 30-day free trial if you’re new to QuickBooks.

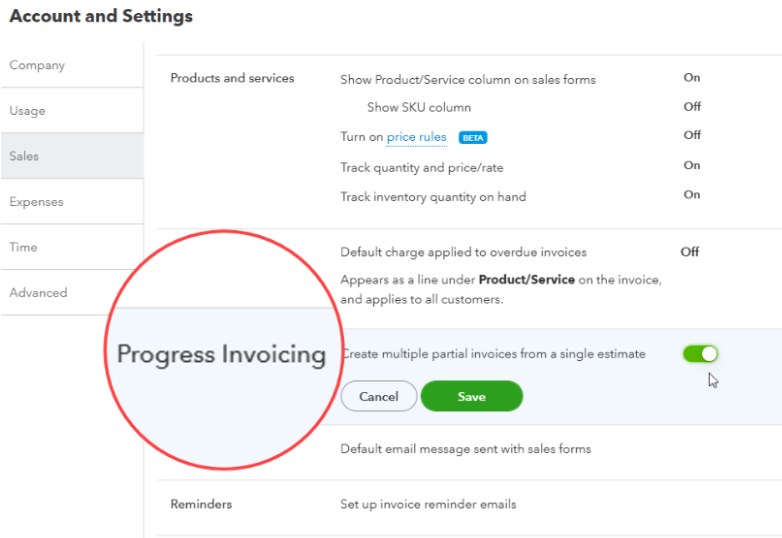

2. Activate Progress Invoicing:

- From Account and Settings > Sales, turn on Progress Invoicing to enable creating multiple invoices from one Estimate. Think of the Estimate (or “Quote” or “Bid”) to be your job budget.

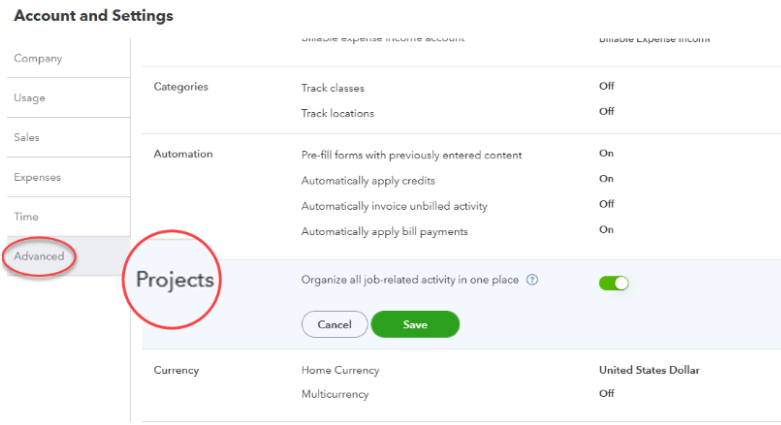

3. Set Up Projects:

- Turn on the Projects feature from Account and Settings > Advanced to create and manage individual projects. This allows you to track income, expenses, and profitability for each project.

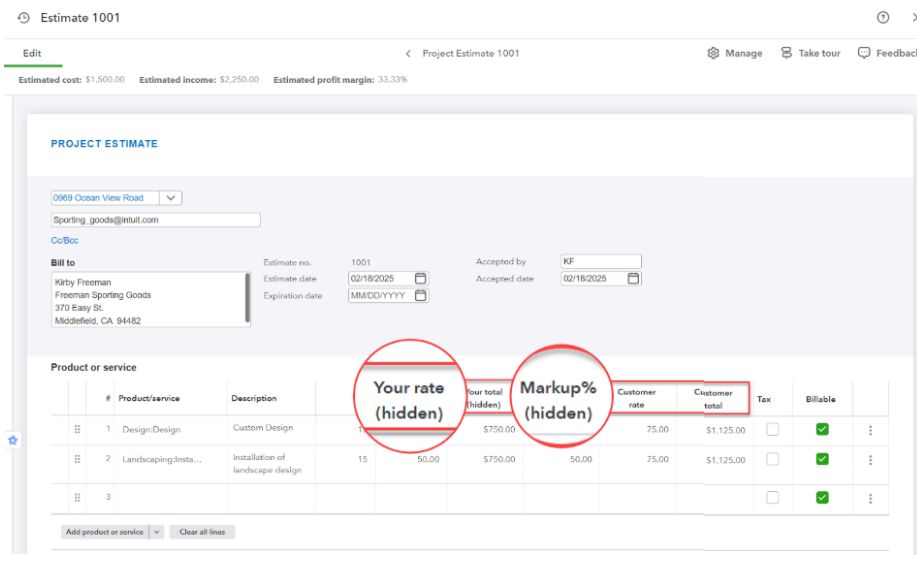

4. Create Estimates and Invoices:

- Use the “Products and Services” feature to create job code items for your estimates and invoices. For each item, enable job cost codes to be used on Sales and Purchase transactions. With QBO Advanced Estimates, you can enter your costs and specify a markup to calculate the customer price:

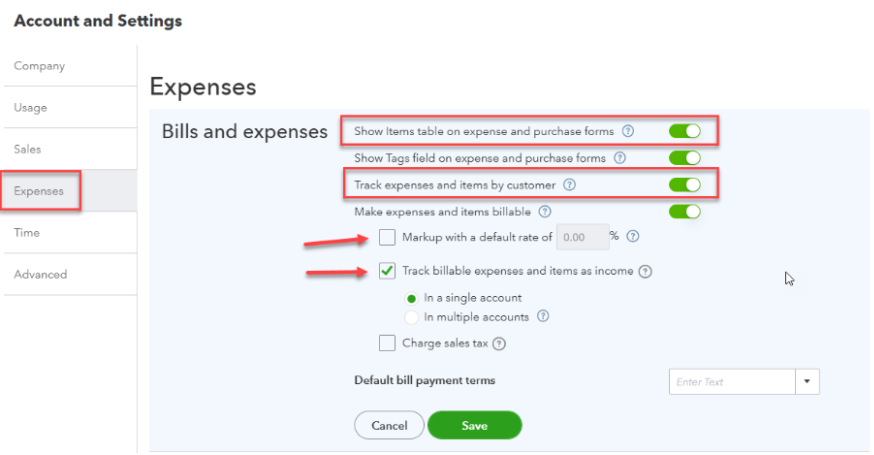

5. Track Expenses to Projects:

- In Account and Settings > Expenses, turn on “Track expenses and items by customer”. Use the Item tab on expenses, checks, and bills and select the job name for all project expenses for materials and external labor (i.e. subcontractors).

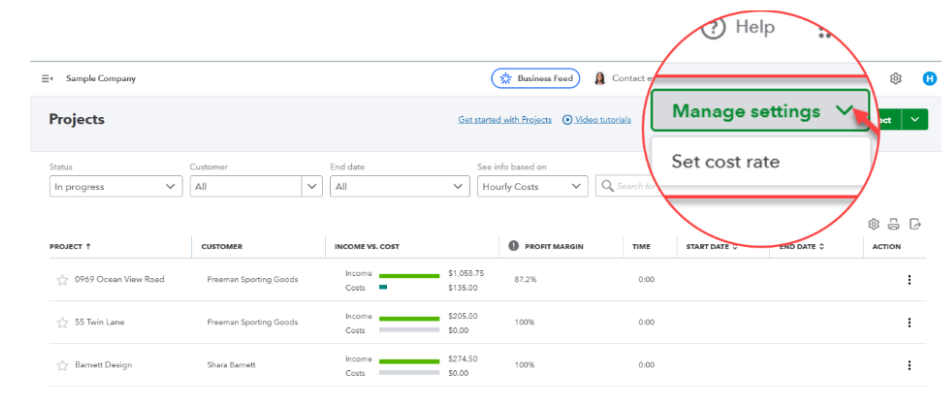

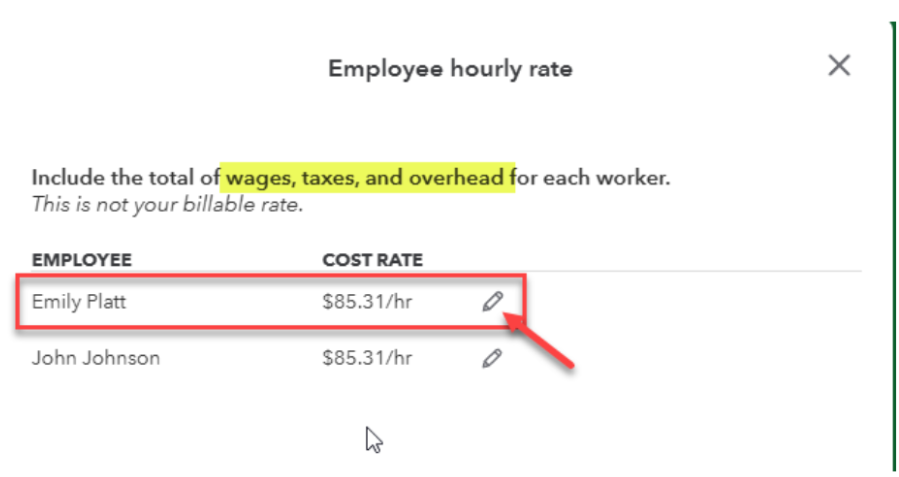

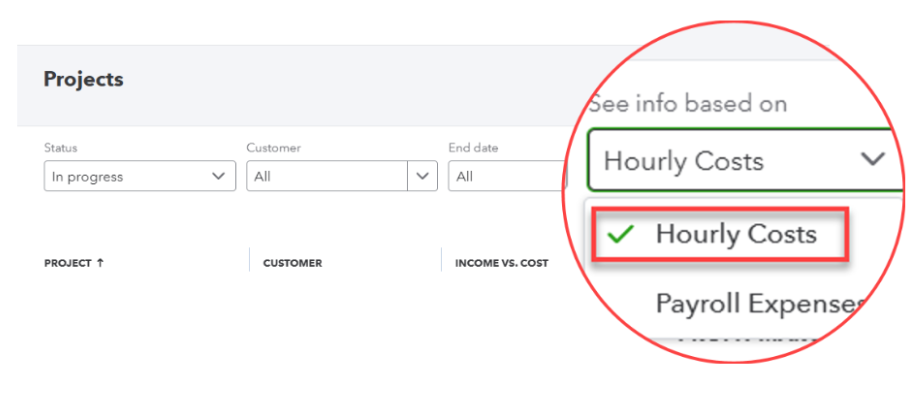

6. Track Labor Costs to Jobs:

- Use the timesheet feature to specify hours by job and cost code. An add-on time keeping app, like QB Time, can be essential here. If you have Intuit payroll, actual employee costs and company payroll taxes will be allocated to the jobs. If you don’t have Intuit payroll, set the Employee Cost rate (including tax and overhead burden) in Project Settings.

7. Generate Reports:

- Use the “Reports” feature to generate financial statements, cash flow reports, and job profitability reports.

- QBO Advanced has an “Estimates to Actuals” report to show project performance to date.

- The Project Center displays Profit Margin by job and has a Job Profitability report.

8. Integrate with Other Tools:

- Integrate QuickBooks Online with other construction management tools like Buildertrend, Knowify, and QB Time to streamline your workflow.

These features help contractors streamline their accounting processes, enhance project tracking, and improve overall financial management. Companies with field workers also need a Field Service Management add-on to handle scheduling and dispatching of remote work. We recommend Results, Method, or ServiceM8 for field service apps – see us for details.

At Siegel Solutions, we have consultants who are certified in Buildertrend and Knowify software as well as other 3rd party add-ons that can help you through the process and set you off on the right track. If you have any specific questions or need further assistance, feel free to ask!

Resources: QuickBooks.com/construction