27 Sep Where Did the Money Go? There is no way I made that much money, I don’t have that much in my account!

Why Profit Doesn’t Always Match Your Bank Balance

Having worked in accounting for about 37 years (holy cow!), one of the most common (and frustrating!) questions I hear is: “If my financials say I made money, why isn’t that money in my bank account?”

It is usually followed by, “something must be wrong with my books” or “that’s impossible, I could not have made that much money.”

These are fair questions — and the answer usually comes down to understanding the difference between *profit* and *cash flow.*

Let’s make this fun…think of your profit and loss as the highlight reel, but your bank account is the blooper reel. Both tell a story — but only one shows how much popcorn you can actually afford at the end of the movie.

Talk to the experts at Siegel Solutions and finally understand what your numbers are really saying.

Profit vs. Cash: Two Different Lenses

- Profit & Loss (P&L): Tells you whether your business *earned* money

- Balance Sheet: Shows all the other ways money moves, many of which don’t show up on your P&L.

That’s where the confusion usually starts. It’s like checking your weight on the scale without realizing you’re holding a gallon of milk — the numbers are right, but they don’t tell the whole story.

Where the Cash Goes

Here are a few common culprits that drain cash even when you’re showing profit:

✅ Owner Distributions: Taking money out for yourself doesn’t hit the P&L — it just reduces cash. Think of it as sneaking cookies from the jar. The jar looks emptier, but nobody wrote it down.

✅ Buying Assets: That new truck, computer, or espresso machine for the office (hey, priorities!) is recorded as an asset, not an expense. Cash goes out, but your profit doesn’t budge.

✅ Paying Down Loans: Principal payments reduce your liability, not your profit. Only the interest shows on your P&L. Translation: the bank gets paid, but your books don’t throw you a party for it.

✅ Inventory Purchases: Stocking up ties up cash until you sell it. It’s like buying a warehouse full of candy bars — until they sell, all you’ve got is temptation.

✅ Timing Issues: You might invoice customers (profit shows up), but if they haven’t paid yet, your bank balance is still twiddling its thumbs.

✅ Timing Issues: You might be paying down a lot of money owed to vendors from the prior year.

✅ Taking out Loans: On the other hand, you may have more cash than profit by taking out a loan, adding to the cash balance, which would not impact your profit and loss (unless your bookkeeper recorded this wrong!)

Why It Matters

Profit is important — it shows long-term business health.

Cash is critical — it pays payroll and bills today.

You need to understand both to keep your business strong. Think of profit as bragging rights and cash as keeping the lights on.

What You Can Do

– Review your balance sheet, not just your P&L.

– Use a cash flow forecast to bridge the gap between profit and bank balances.

– Lean on your bookkeeper/CPA to help interpret the numbers and plan ahead.

Bottom line: Profit doesn’t always equal cash. Once you understand what’s happening on your balance sheet, you’ll see where the money really went — and feel much more confident running your business.

And next time you ask, ‘Where did the money go?’ At least you’ll know it didn’t run off to Vegas without you.

A Quick Story

Imagine you run a bakery. Your P&L says you made $50,000 in profit this year. But when you check your bank account, it feels like there’s barely enough left to buy a bag of flour. What happened?

Well, you bought a new oven (asset purchase), paid down part of the loan on your delivery van, and stocked up on three months’ worth of sugar and flour. Your financials say you’re profitable — and you are — but that cash has been reinvested in the business, not just sitting in the bank. This is exactly why profit doesn’t equal cash.

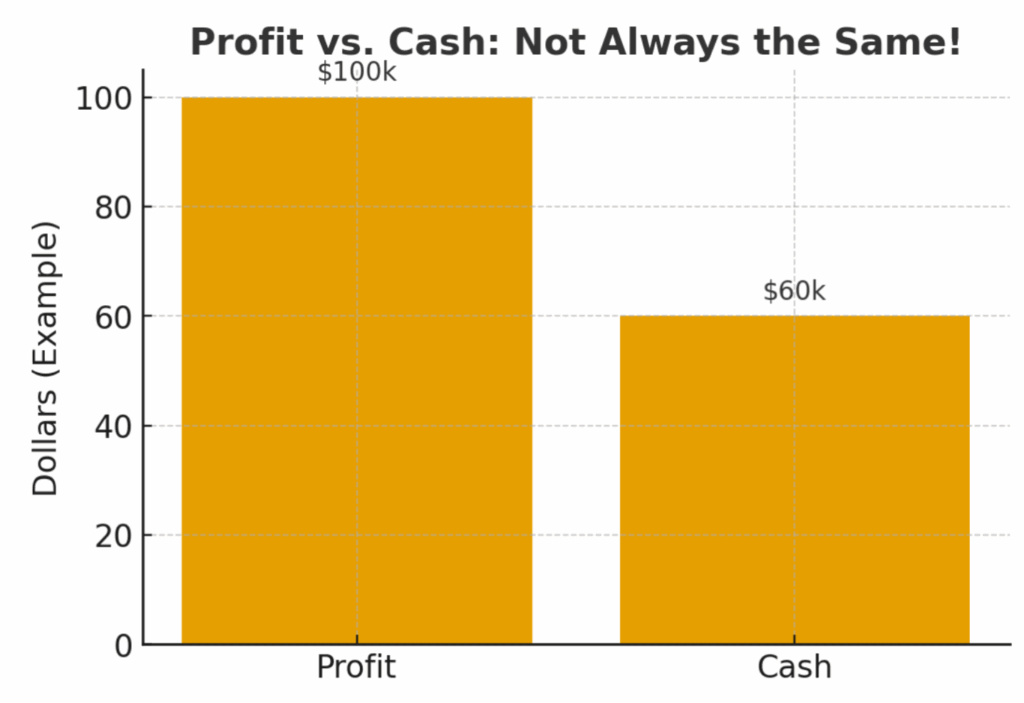

Visual Snapshot

Here’s a quick way to think about it:

The graph on the right would be after you took your $100K in profit and maybe took out a distribution, bought a truck and have not been paid by some customers that were invoiced!

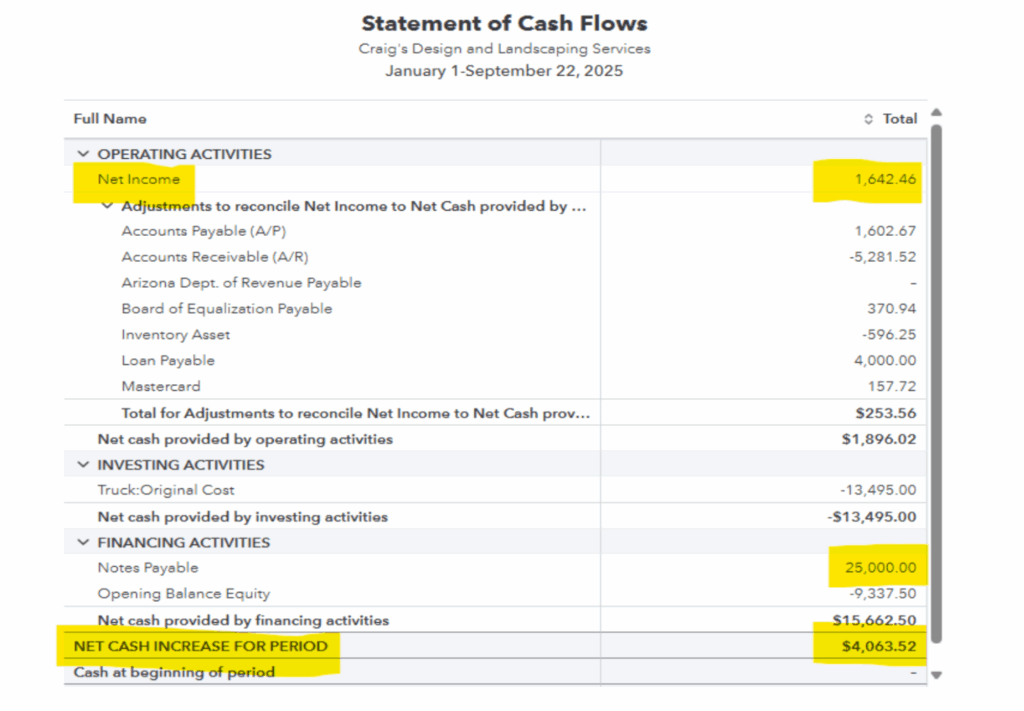

The One Financial Statement that helps show these differences!

My favorite statement which most business owners don’t even know exists is called “The Statement of Cash Flows”. This statement starts with the “Net Income” (profit),and shows you all the transactions that impacted your Cash balance that did not impact your profit. The bottom of the statement will show you the ultimate change in your cash based on all these transactions plus the Profit.

An example is as follows:

The above shows net income of $1642.46 for the period, but in this case, it shows cash went up, actually $4063.52. How can it be? I actually have more cash than what I made! Well under closer look, a big increase in our cash was due to an increase of $25,000 with a note and actually another note of $4,000. We even show $13,485 came out for a truck purchase, but overall, our cash went up! The reverse could happen in the next year, as we start paying down the notes, cash will go down without any impact on the Income Statement causing that initial question – Where did the money go?!

At Siegel Solutions, we strive to help our clients understand what is happening in their financial statements and cash flow is a big part of that discussion. We also build out budgets that include the cash impact that many other professionals may not show. It’s pretty easy to build out a Profit & Loss statement showing how much profit a company can earn, but that does not show the cash impact! The budget should include a cash budget to show what you are going to spend on equipment, loan repayments, new loans, distributions, timing of customer payments, as well as vendor payments.

We are here to help! Reach out anytime!